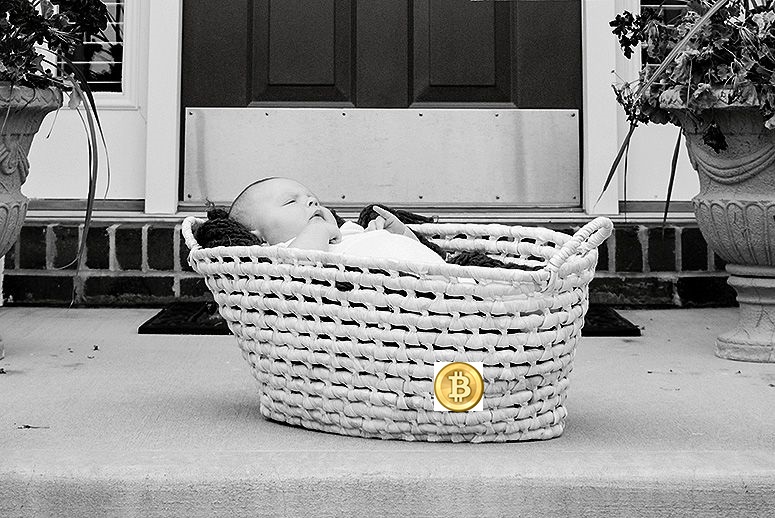

Bitcoin Adoption is in its infancy

November 25, 2019

Price Does Not Always Reflect True Value

After 10 years in existence, the question of if and when mass crypto adoption occurs is still up to debate in the cryptocurrency space. Humans historically think in linear scale. Once a personal investment is made, it is in our nature to believe in a steady, linear rise higher. Against the background of a technologically exponential environment, bitcoin lends itself to allowing exponential adoption growth rates along with volatile pullbacks. To be accepted in mainstream, bitcoin gets adopted and THEN rises in value. It doesn’t get adopted because its risen in value, it RISES in value because it is adopted. This is why the bitcoin price runup of 2017 created unfair, inflated prices based upon utility as opposed to true value. It was not a sustainable fair market price, and quickly rejected. Value MUST be driven by mass usage and commensurate adoption rates, THEN go up in price. These are birth pains of a new currency self-adjusting to its respective auction market.

What is Mass Adoption?